Departmental Activity

Departmental Schedule

- Mon - Tues :

10.00 am - 05.00 pm

- Wednes - Thurs :

10.00 am - 05.00 pm

- Fri :

10.00 am - 05.00 pm

- 2'nd & 4'th Sat.

Open

- Sun :

Colosed

About Department

About Department

Our Department The Department of commerce was established in the year 1972 right at the inception of the college. The departmental facilities Mr. V.S. Pawar, Mr. P.M. Munde, Mr. M.B. Rathod and Dr. S.G. Jahagirdar had taken efforts and contributed a lot for the development of the department. The department has a tradition of good devoted professors who are always ready to extend their helping hand to the students. The department conducts regular industrial visits for the students. Associate professors Dr. Sannake A.C. and Dr. Choudhari V.M. have both completed their Ph.Ds., Dr. V.M. Choudhari has also been elected as the Board of Studies member in the University elections. All the faculty members always stay in touch with the student and keep them informed about the various career opportunities and competitive examinations. The lecturers make good use of ICT tools and techniques for teaching, a bridge course is conducted at the beginning of the academic year for the new students to acquaint them with the course curriculum and career opportunities in the field of commerce. The department has a tradition of good results, most students pursue post graduation. |

Programme Offered

Programme Offered

About Program

Our Courses

![]() Eligibility Criteria

Eligibility Criteria

![]() Eligibility Criteria

Eligibility Criteria

![]() Eligibility Criteria

Eligibility Criteria

Syllabus

Syllabus

Teaching Syllabus

Programme Outcomes

Programme Outcomes

PO-CO-PSO

|

Upon completion of B. Com Degree program, the graduates will be able to, |

|

|---|---|

| Course | Course Outcomes |

|

5) Course Outcome (COS) Financial Accounting-I | 1) To understand the principles of accounting and its concepts. 2) Compare between higher purchase and installment system and prepare and provident. 3) Describe the types of co-operative societies and prepare trading and profit & loss account and balance sheets. 4) Compose internal consistence of the business organizations and key managerial personal. 5) Responsibilities of chairman and chief executive. 6) Explain the meaning joint venture account and right methods of joint venture accounting. 7) Design the numerical on centralized and decentralized method. |

|

|

1) Discuss nature and the scope of business and classify the business activities. 2) Identify the meaning of the sole partnership one person company, private company and Joint Stock Company. 3) Justify the functions, principles and types of the organization. 4) Compose internal consistence of the business organization and management personal. 5) Summarize the qualities powers responsibilities of Chairman and Chief executive officer. 6) Paraphrase e-commerce and e-business banking. |

| Course: Entrepreneurship Development program |

|

| Course: Corporate Accounting: |

1) Understand the procedures for the issue of shares.

2) Prepare final statement of Companies.

3) Calculate purchase consideration in case of amalgamation, absorption and reconstruction.

4) Ascertain profit or loss prior to incorporation by applying various methods.

5) Identify the methods of valuation of Goodwill and shares.

|

| Course: Business and Industrial economics: | 1) Understand the nature and scope of the business economics and their responsibilities. 2) Describe the law of the demand and Griffins paradox and methods of demands for costing. 3) Evaluate the concept of production, function and law of variable properties and ISO quant curves. 4) Design the theory of the population and then criticize it. 5) Describe law of the supply and its criticism and evaluate concept of cost. 6) Write down the theory of the revenue. |

| Course: Business Mathematics & Statistics: | 1) Write the measures, scope, function and limitation of statistics. 2) Calculate mean, median and mode and geometric mean. 3) Evaluate mean deviation, standard deviation and quartile deviation. 4) Solve Sequence, Karl Pearsons and co-efficient of co-relation. 5) Calculate ratio & proportion, percentage, simple and compound interest and profit or loss. |

| Course: Income Tax | 1) Understanding the concept of Income tax. 2) Solve a numerical under the head of Income from salary. 3) Solve a numerical under the head of Income from preparing. 4) Calculate the numerical of Income from other sources. |

| Course: Cost Accounting | 1) Understand the difference between Cost and Financial Accounting. 2) Prepare the profit reconciliation statement. 3) Define Job costing and Process costing. 4) Determine contract costing, its elements and features of contract costing. 5) Classify normal & abnormal loss and normal & abnormal gain. |

| Course: Indirect Taxes | 1) Understand the concept of central excise laws. 2) Determine the customs laws. 3) Analyze the service Tax, Provision of law and procedure. 4) Understand the basic concept of values added tax on sale or purchase of goods. |

| Course: Management Accounting | 1) Compare differences between Cost Accounting and Management Accounting. 2) Calculate the break even – point analysis. 3) Prepare cash budget and flexible budget. 4) Explain the meaning, importance and limitation of ratio analysis. 5) Calculate Ratio, acid test ratio, inventory turnover ratio. 6) Prepare statement showing changes in working capital and fund flow statement. |

| Course: New Auditing Trends | 1) Acquaint the students with the practical approach of auditing. 2) Understand objects and importance of auditing. 3) Commerce different types of audits. 4) Understand the audit sampling. 5) Solve profit & loss account and construct balance sheets. |

| Course: Advanced Financial Accounting | 1) Create awareness among the students about Advanced accounting issue and practices. 2) Understand Nature and functions of Advance financial Accounting. |

| Course: Business Communication | 1) Develop communication skills and use of electronic media in business communication. 2) Learn the way to overcome communication barriers. 3) Practice modern forms of communication. 4) Formulate job related communication and resume preparation. 5) Attend interview and participate in Group Discussion with Confidence. |

| Course: Computer Application Business | 1) To understand the components of computer. 2) Provide the knowledge about on overview of E-Commerce and E-Business. 3) Describe the consumer oriental E-Commerce Applications. 4) Appraise the Electronic Data Interchange and its pre-requisites. 5) Analysis the different types of E-Marketing techniques. 3) Discuss nature meaning and objectives of accounting standards. 4) Understand departmental accounts. |

| Course: Company Law | 1) Understand the background of the New Company Act 2013 and explain kinds of company. 2) Define memorandum of association and articles of association. 3) Determine private placement and prospectus and mis presentation in prospectus. 4) Write the meaning and nature of capital share and capital. 5) Indentify the difference between shares and debentures and owned capital and debt capital. 6) Explain membership in a company and its procedure and analyze. |

| Course: Banking | 1) Understand the relationship between the banker and the customer, how to apply crossing and endorsement in cheques. 2) Understand about commercial banks, EXIM banks and their functions. 3) Analysis about the technical banking, mode of charging security. 4) Evaluate the elements of mechanical banking. 5) Understand the function of Reserve Bank of India and method of audit conduct. |

| 6) Program Specific Out Comes (PSOs) | |

| PSO-1 | Apply different concepts in starting and managing business and realize the social responsibilities social realities and inculcate an essential value system. |

| PSO-2 | Solve problems related to employee, investors and consumers with legal. |

| PSO-3 | Prepare financial statements of business using accounting principles, concepts, conventions and provisions. |

| PSO-4 | Develop necessary professional knowledge and skills in finance and taxation. |

| PSO-5 | Implement traditional and modern strategies and practices of costing, banking, economics, marketing, management, auditing and taxation. |

| PSO-6 | Practise different techniques of communication and apply it in business and profession |

| PSO-7 | Use mathematical and statistical tools in academics, business and research. |

| PSO-8 | Develop competency in student to make them employable in the global market. |

| PSO-9 | Develop the skills of students to equip themselves as successful entrepreneurs. |

| PSO-10 | Enhance practical knowledge to prepare various accounts in order to meet the national requirements. |

Teaching Staff

Teaching Staff

About Our Staff

|

| ||||

|---|---|---|---|---|

| Sr.No. | Faculty Name | Qualification | Designation | View Profile |

| 1. | Dr. Sannake Amasiddha Chandrasha | M. Com. SET, NET, Ph.D | Head of the Department | Click Here |

| 2. | Dr. Choudhari Vikas Motiram | M.Com. M.Phil. Ph.D. | Associate Professor | Click Here |

Activity

Activity

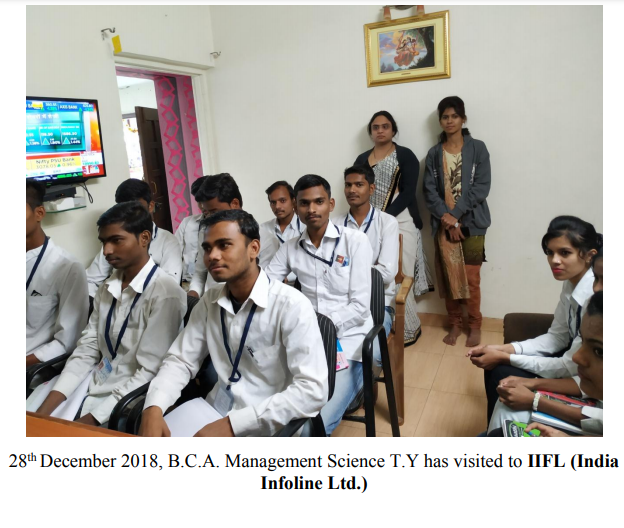

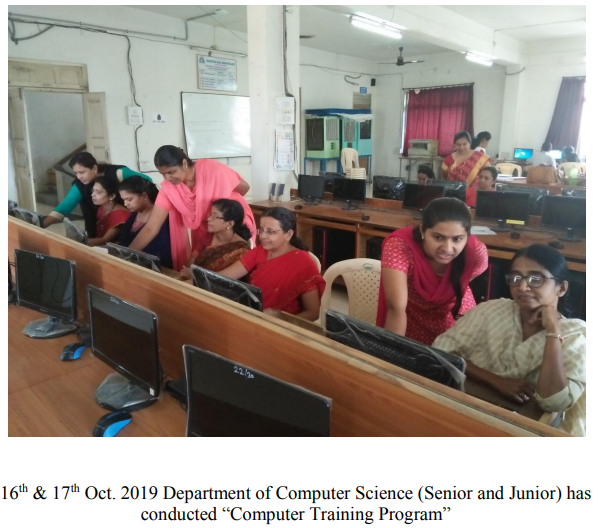

Departmental Activity

![]() Departmental Activities

Departmental Activities

1. Wall paper ‘ORBIT’ 2. Best Paper cut activity 3. Use of LMS such as Moodlecloud and Google Classroom 4. Online teaching using Zoom and Google Meet 5. Students’ Seminar 6. Quiz Competition 7. Cross word and word puzzle solving 8. Mentor-Mentee Mechanism 9. Group Discussion 10.Continuous assessment programme 11. Departmental Library 12. Whatsapp Groups of all students for communication |

View Activities here..

|

|

|

|

Alumini

Alumini

About our alumini

| |

|

|

| |

|

| View Profile |

|

| |

|

| View Profile |

|

| |

|

| View Profile |

|

| |

Contact with Us..!

B. Com I (1st and 2nd semester)

B. Com I (1st and 2nd semester)